1. Seamless GSTR 1 to GSTR 9 Filing

Fetch and autofill all the data to file GST returns in minutes with HostBooks GST solution

2. Reconcile Every Transaction to the Detail

HostBooks GST filing software is integrated with HostBooks Accounting software and equipped with advanced AI-powered reconciliation that ensures seamless matching of data between all the sources to identify any discrepancies.

3. Effortless E-Way Bill Generation

Simplify the process of generating, editing, and managing e-way bills with the built in E-Way bill generation.

4. Import Data Like a Breeze

HostBooks provides the most automated and easy process to import data from your accounting system, billing software or ERP.

5. Reports at your Fingertips

Empower your business with the most comprehensive GST reporting framework.

6. E-Invoicing Easier than Invoicing

Simplify e-invoicing with streamlined workflow and robust integration, making the process easier than traditional invoicing.

7. QRMP Scheme Opter? We Got You Covered too.

Designed to address the needs of Quarterly Returns with Monthly Payment (QRMP) Scheme opters, HostBooks offers comprehensive GST application.

8. Registered in Composition Scheme? Even Better

For those taxpayers who do not want to take trouble and are registered under Composition Scheme.

9. One Click GST Payment and Challan Generation

Experience seamless and lightning-fast challan management and GST Payment with HostBooks.

10. Security Beyond ID- Password

HostBooks GST software has implemented robust security measures to ensure the highest level of protection.

11. Lightning-Fast Performance

Experience unparalleled user experience driven by lighting fast performance of HostBooks GST return filing software.

Import Data Directly from Excel, Tally, Busy and Many Other ERPs

Quick Integration for Tally User

HostBooks GST Software offers seamless integration with Tally for effortless data transfer ensuring accurate and up-to-date GST records. The integration automates reconciliation, eliminates duplicate data entry, and provides real-time updates, streamlining the GST filing process.

GST Filing for Flipkart and Amazon Sellers:

One Click Integration

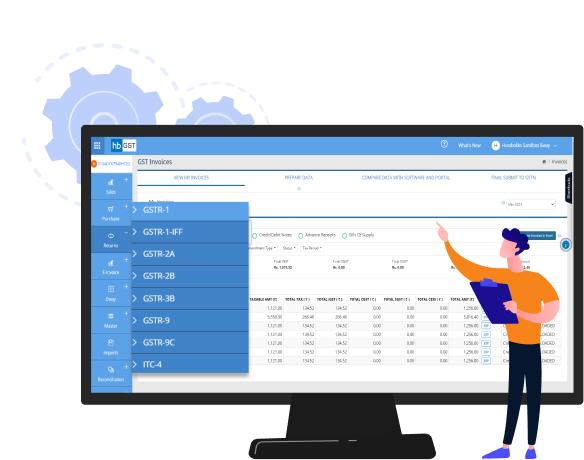

HostBooks GST Return filing Software is a specialized tool developed to simplify and streamline GST reconciliation, e-filing, return filing, and other compliance processes for businesses. It offers efficient management of GST-related tasks, making GST compliance simple, fast, and convenient.

HostBooks GST Software allows you to manage various types of GST returns, including GSTR-1, GSTR-3B, GSTR-6, GSTR-9, GSTR-9C, and more.

HostBooks GST Software is designed for user-friendly navigation and intuitive workflows. With features like 3-click return filing, error detection in seconds, and automated data validation, users can quickly adapt to the software.

Yes, HostBooks offers a free demo of the GST software to help you experience its features and functionalities before making a purchase decision.

Absolutely, our GST Billing Software provides a integrated approach for generating e-way bills and e-invoices. You can easily generate e-way bills and simplify the e-invoicing process with streamlined workflows.

HostBooks GST Software automatically calculates Input Tax Credit and tax liabilities, reducing human errors. It enables you to maximize eligible ITC claims, optimizing your tax benefits and simplifying the ITC tracking process.

The different types of GST returns include GSTR-1, GSTR-3B, GSTR-2B, GSTR-6, GSTR-9, GSTR-9C, and more. Each return form serves a different purpose and must be filed within the specified due dates.

GST filing software is a specialized tool designed to simplify and streamline the process of filing GST returns, reconciling data, and ensuring GST compliance for businesses. It automates tasks like invoice generation, return filing, and error detection, making GST compliance easier and more efficient.

Various software companies and developers have created GST software. Some well-known companies in this domain include HostBooks, Tally Solutions, ClearTax, Marg ERP, and many more.

To download GST software, you can visit the official website of the software provider you wish to use. Look for the download section or follow the instructions to download the software to your computer or mobile device. Some GST software solutions may also be available on app stores for easy installation.

HostBooks GST Software is designed for user-friendly navigation and intuitive workflows. With features like 3-click return filing, error detection in seconds, and automated data validation, users can quickly adapt to the software.

Yes, HostBooks GST filing software seamlessly integrates with Tally, ensuring smooth data transfer between the two platforms. It synchronizes financial data, automates reconciliation, and provides real-time updates.

HostBooks ensures the utmost data security with bank-grade encryption and compliance with ISO 9001 and ISO 27001 certifications. Your financial data remains confidential and protected throughout the platform.

With HostBooks GST solution you can easily import data from accounting systems like Tally or ERP. Also you can easy import customers, invoices and other details using flexible excel formats.

Yes, HostBooks GST Filing solution allows you to manage multiple GSTINs and businesses under one platform. You can easily switch between different entities and handle GST compliance across all your business verticals.

HostBooks GST Software can be easily implemented within minutes. Its simple installation process and configuration for GST details enable a quick start, making your business GST-compliant in no time.

Yes, HostBooks GST Software is designed to cater to the needs of small businesses and composition scheme opters. It offers simplified compliance processes, lower fixed tax rates, and efficient return filing for such businesses.

GST return is a document that contains details of a taxpayer's income, tax liability, and tax paid during a specific period. Businesses registered under GST are required to file various GST returns, such as GSTR-1, GSTR-3B, and GSTR-9, on a regular basis.

The best GST software depends on your specific business requirements and preferences. There are several reputable GST software providers, such as HostBooks, Tally, ClearTax, and more, offering robust features and functionalities. It is recommended to compare their offerings, user reviews, and customer support before choosing the one that suits your needs.

The price of GST software varies depending on the provider, features, and the scale of your business. Some software may offer free plans with limited features, while premium plans with advanced functionalities may have a subscription-based pricing model. The price of HostBooks GST software starts at

No, GST (Goods and Services Tax) is not applied to salary income. It is a consumption-based tax levied on the supply of goods and services. Salary income is subject to other forms of taxation, such as Income Tax and Professional Tax, depending on the laws and regulations of each country.

GST is calculated on the taxable value of goods or services at the applicable GST rate. To calculate GST, multiply the taxable amount by the GST rate (CGST + SGST or IGST, as applicable). For example, if the taxable value is ₹1,000 and the GST rate is 18%, the GST amount would be ₹180 (₹1000 * 18/100).

Try HostBooks

SuperApp Today

Create a free account to get access and start creating something amazing right now!